This Level 2 financial record-keeping module has been designed to build upon the record-keeping modules covered in Level 1. The record-keeping and benchmarking modules are designed to be used by a wide range of producers and management systems.

Keeping your farm financial records up to date can be one of the most effective ways to measure your profitability and achieve a higher return for your effort. Preparing and understanding farm financial statements is the first step.

Some of the benefits of keeping farm financial records accurate and updated include:

- Avoiding over/under tax payments

- Ensuring you are not living on equity

- Easier to prepare accounts at year end

- Help planning for GST/HST filing (payments)

- Identifying financial strengths and weaknesses in your farm business

- Simplifying processes for qualifying for loans or selling the business

- Helping to prepare an annual budget and managing cash flow

In agriculture there are many areas of risk and uncertainty. Sectors with tight margins, such as the beef sector, can greatly benefit from having a better understanding of their operation’s finances. Understanding where the strengths and weaknesses occur is one way to reduce the stress that comes with uncertainty and provide financial resiliency to help your operation adapt to challenges.

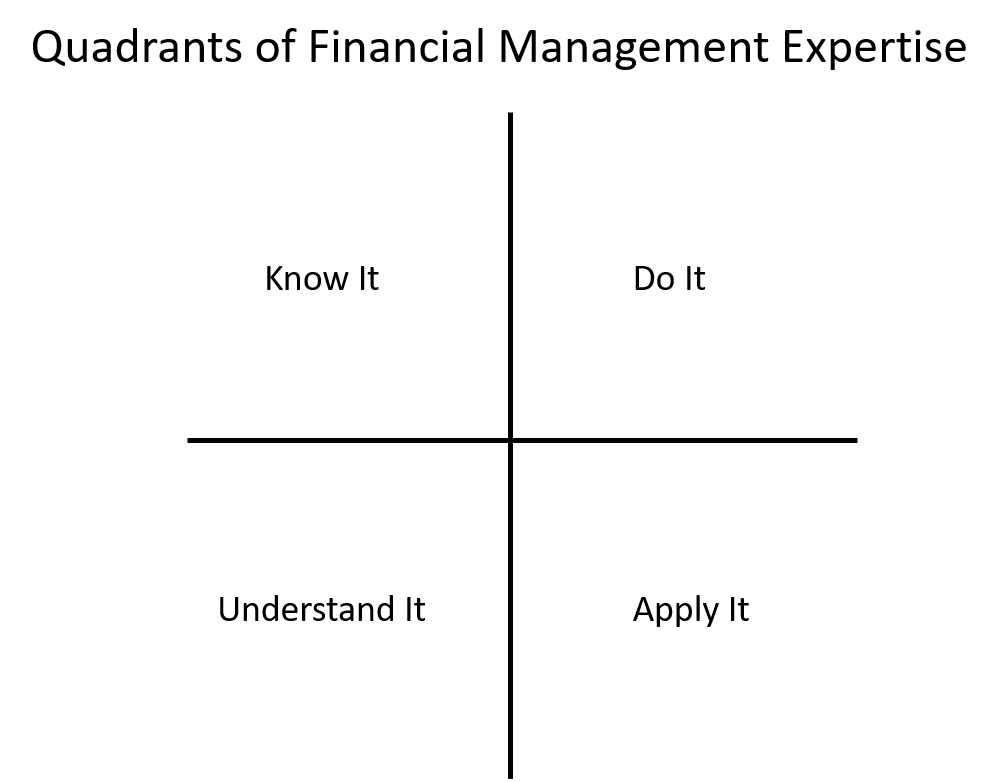

Understanding the Four Quadrants of Financial Management begins with understanding what financial management looks like in order to ultimately reach your financial goals:

Know it: Knowing what financial management is, what the various types of accounting sheets are, and how to enter data

Do it: Enter the data, make the calculations for the financial statements

Understand it: Understanding what the information is telling you

Apply it: How to use this information from financial statements to reach your goals

Cash vs. Accrual Accounting

In general, when speaking about farm accounting there are two types: cash and accrual accounting. The difference between the two approaches is the timing when revenue and expenses are recorded. Cash accounting is recorded when money changes hands (e.g. date the cheque is written, or the date on the paper receipt).

Accrual accounting records an accounts receivable when it is earned, even if you will get paid at a later date. Similarly, an accounts payable records expenses or bills based on the date of the invoice, even if you will be paying them in the future. (See the Income Statement section for more details on how this can be applied).

You can convert from one type of accounting to the other depending on your needs. Many producers use cash accounting for their business and tax purposes and then convert to accrual accounting for things like Agri-Stability applications.

Sole Proprietorship vs Incorporated Company

Depending on the structure of your farm business, your operation may be set up as a sole proprietorship, partnership or as an incorporated company. The structure will impact whether your operation needs to maintain a balance sheet. When your farm is incorporated, you are required to file a balance sheet with your tax return (T2). A sole proprietor or partnership that is not incorporated is not required to maintain a balance sheet.

Sole proprietorship: has sole responsibility for making decisions, receives all the profits, claims all losses, and does not have separate legal status from the business

Incorporated company: is a form of business ownership that creates a distinct legal entity separate from its owner(s) or shareholder(s)

Financial Statements

For an introduction to financial statements watch this video.

Balance Sheet

Most farm businesses are made up of a combination of land, cash, livestock, crops, and machinery (assets), debt (liabilities) and invested equity. The balance sheet summarizes the assets and liabilities for your business. It is like a photograph of these assets (investments and cash) and liabilities (debt) on a given date.

Assets = liabilities + equity

Assets: include cash, accounts receivable, inventory (e.g. livestock and crops), automobiles, machinery and equipment, and property (e.g. land and buildings)

Liabilities: include accounts payable, credit cards, mortgages and loans

The balance sheet often reports items as current (less than 12 months), intermediate (1-10 years) or long term (more than 10 years) which includes mortgages and longer-term loans. You may have one business balance sheet and one personal balance sheet for off-farm self-employment.

Tip for reviewing balance sheets:

– Save balance sheets by date and make comparisons at the same time each year

Data to record: Inventories of all commodities on the farm. Many accounting programs will automatically reduce inventory when commodities are sold. If using an excel or paper system remember to reduce commodities on the balance sheet as you sell them. An ongoing record of livestock inventories (total, deaths, missing, sold, purchased, etc.) can help keep your balance sheet current and avoid additional work when the data is needed. Crop or forage inventories can be recorded following harvest or when feed sources are purchased.

When to record it: The month of your year end

Net Worth Statement

Your Net Worth Statement is similar to the balance sheet, evaluating assets and liabilities. Where the balance sheet represents costs (less depreciation), the net worth statement reports fair market value.

Net worth = fair market value assets – fair market value liabilities

Comparing Net Worth Statements compiled at the end of each year and over several years can help you measure the progress of your farm business. The net worth statement also helps you judge the ability of the farm operation to pay off current debts and take on additional debt.

Data to record: Start with the balance sheet and adjust every value to the current fair market value of the date selected.

When to record it: When you are going to be using the statement, because current values are used and they change.

Difference between a Balance Sheet and Net Worth Statement

A balance sheet provides the purchased value for assets. These are stable numbers that do not fluctuate from year to year. On the capital asset side, the balance sheet is the cost of the assets less depreciation. The purpose of this information is to provide a more stable valuation that does not fluctuate with the markets. This shows the farm’s ability to produce income. This is what you use for calculating financial ratios (see Level 3 for more information on financial ratios).

A net worth statement uses current fair market values for your assets. Having a list of current fair market values provides greater borrowing power when talking with a banker about a loan because it shows the appreciation of assets and loan carrying capacity.

Making Sense of Farm Equity and Net Worth

Equity is the value of a property in excess of all liabilities against it. In sole proprietorships and partnerships net worth is equivalent to retained earnings (aka shareholder equity). A corporation has multiple sources of equity (shares and retained earnings).

Equity = assets – liabilities

Commodity markets, including beef, work in a 10-12-year cycle of highs and lows. During the years with improved profitability, operations can build up farm equity (e.g. land or breeding stock). Building equity when profitability is high helps to mitigate risk when profitability is low.

Data to record: The information needed to review farm equity can be found in the balance sheet.

Example: Consider two scenarios: in both cases the operations are farmed identically, and the land will be used as a retirement fund. However, not all investments in assets (such as land or equipment) result in building of equity over time.

Scenario 1: An operation where land is owned outright (inherited from the previous generation) and is expected to increase in value over time (providing a retirement fund). During the years when prices are high, income is spent on equipment. During years of negative margins, assets like land and cattle are liquidated. Over time, the new equipment depreciates in value, while the appreciation in land value occurs on fewer total acres. Consequently, equity is reduced over time.

Scenario 2: An operation where land is owned outright (inherited from the previous generation) and is expected to increase in value over time (providing a retirement fund). During the years when prices are high, income is spent on land purchases. Payments are made on an annual basis, including interest. In good years, additional income is spent on paying down loan principles or invested. During years of negative margins, investments may be sold or the land can be used as collateral for a bank loan. Over time, equity is built as new land purchases add to the existing land base; amplifying the appreciation in land value. Consequently, equity is increased over time.

By the time of retirement, the operation in the second scenario will have more assets to work with due to the investment in assets that will increase in value, such as land.

Income Statement

We have just talked about how you may spend your money on assets. Now we will focus on how you generate that cash. A farm income statement is a summary of income and expenses that occurred during a specified accounting period, usually the calendar year. It is a measure of inputs and outputs in dollar values. It also offers a condensed view of the value of what your farm produced for the time period covered and what it cost to produce.

Net Income = income – expenses

Most farm managers do a good job of keeping records of income and expenses for the purpose of filing income tax returns. Values from the tax return provide a historical perspective on the income generating capability of the assets. In order to look forward in predicting the financial performance of the farm for the next year one must look at the combination of the balance sheet and income statement together.

The income statement will look different for a cash or accrual accounting system (see table below). Remember that the difference between cash versus accrual accounting is about the timing of when revenue and expenses are recorded (see Cash vs. Accrual Accounting section above).

A cash income statement identifies when expenses are paid and revenue is received, at cost. An accrual income statement gives you the opportunity to see the change in value of inventories (e.g. grain, hay, cattle) and recognize produced inventory.

Income statements (sometimes called a profit and loss statement) can be presented in different ways: with depreciation, without depreciation, with income tax, and without income tax.

Data to record: Collect receipts related to your farm business, remember to ask for receipts when you travel for your farm business.

When to record it: (see Table below) Monthly in conjunction with review of the bank statement.

Example: The property tax for your operation is $1,000 each year. For unforeseen reasons, you need to pay two years’ worth of property tax at the same time. In cash accounting, this payment appears in your records as $2,000. In an accrual accounting system, the expense is recognized as $1,000 in year one and $1,000 in year two; because the payment is for two separate annual payments (with $1,000 recorded as an account payable).

Cash Flow Statement

The cash flow statement is your everyday cheque book accounting which shows money coming in and going out. With the cash flow statement, you can plan your income and expenses over the year.

By having a better understanding of your cash flow over the span of a year you can identify:

- If you may need an operating loan

- When to schedule mortgage or other large payments

- When to schedule capital purchases (i.e. equipment, land, infrastructure, etc.)

Data to record: Most of the information needed to prepare a cash flow statement can be found in combining information from the income statement and balance sheet.

When to record it: (see Table below)

Example: A producer is using cash accounting for tax purposes. He adds a balance sheet to his accounting set up, with stable asset values. He can now use his income statement along with the balance sheet to create a cash flow statement. The balance sheet shows land was purchased (increasing assets) utilizing a bank loan (increasing liabilities). The cash portion of the land purchase shows up as a decrease in cash on the cash flow statement. With this purchase more inventory was produced showing up on the accrual income statement and the balance sheet as having more inventory for sale.

Differences between Income Statement and Cash Flow statement

Terminology matters, but we don’t always correct each other. Imagine you are picking up your city cousin at the airport and on the way home they admire the herd of “cows” in a field. Do you point out that they are actually “steers” or not? A castrated male is significantly different than a reproducing female – but the clarification is not always needed. Accounting, like the beef industry, has its own set of terminology. Sometimes, different names are used for the same financial statements (such as profit and loss statement or income statement). But the differences matter if you are going to be digging into your own farm financials.

An income statement is different from a cash flow statement as shown in the table below and described in the financial statements video above.

- Items in bold and italics denote the differences between using a cash or accrual accounting system. This is about the differences in timing of when sales, other revenue and expenses are accounted for.

- It should be recognized that a cash flow statement is the same regardless of the accounting system used because it is about the cash flowing into and out of a bank account.

- Items in bold only, denote the differences between items that are included in one type of statement but not another.

- This is the farm cash flow, not a household cash flow.You can choose whether T4 wages are included in the cash flow even thought they are not part of the farm. Particularly if they are subsidizing the farm with off-farm income to make loan payments.

Questions about reading financial statements can be directed to your accountant.

Table 4: Differences in data used for cash and accrual Income Statements and Cash Flow Statements

| Income Statement using a Cash accounting system | Income Statement using an Accrual accounting system | Cash Flow Statement |

|

Income

Other Income

|

Income

Other Income

|

Income

Other Income

|

|

Expenses

|

Expenses

|

Expenses

|

Calculating COP

Calculating your cost of production starts with collecting the production and financial records for your operation mentioned in the previous modules. In order to not be overwhelmed, it can be easier to track production information periodically throughout the year.

Tips to help you get started:

- Figure out what your production costs are. You can figure this out by having a conversation with your accountant or using the costs submitted for farm insurance or business risk management programs.

- Determine your costs on a per cow basis. This is calculated by dividing total costs by your ACTUAL number of cows. This takes into account the reproductive efficiency.

- Keep a monthly feed inventory to help determine your feed costs. What was fed? How much? What was the cost?

- Keep track of when you started winter feeding and when cattle were turned out onto pasture.

- Cost of pasture

- Cost of herd health program

- Infrastructure/equipment costs, labour, depreciation (more in-depth enterprise analysis to be covered in Level 3)

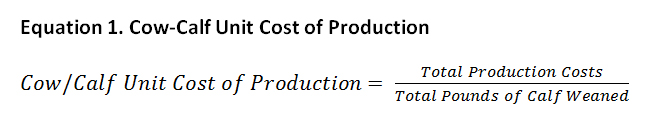

Per Unit Cost of Production

For cow-calf producers, determining the break even price of your calves is one of the first steps you can take towards using records to ultimately improve profitability. The break-even price on weaned calves is known as the cow-calf unit cost of production. Often, cost of production benchmarks are reported as dollars per cow, but having the cost of production is in dollars per lb of calf weaned allows you to develop a risk management plan (such as knowing the level of price insurance to cover costs, if available in your area) and know profitability as soon as the sale price has been set.

However, a cow-calf operation rarely exists as a sole enterprise. If a producer has a cow-calf operation, raises their own replacement heifers, keeps back some calves to background and sell in the spring, and produces their own hay and pasture to graze, they essentially have five enterprises or business lines.

Each of these enterprises has its own cost of production. It is advisable for a producer to separate their costs and revenues into the respective enterprises to determine the cost of production for each. Doing so will enable a producer to see which enterprises are making money and which are losing money.

One method of looking at your per unit cost of production or break-even price is by dividing total production costs for the cow herd by the total pounds of calf weaned (see Equation 1 below). As the equation illustrates, a producer’s break-even price can be improved by either: a) reducing production costs, or; b) increasing pounds of calf weaned. Knowing production costs expressed as $/lb of weaned calf allows for direct comparisons with market prices.

A free, Microsoft Excel-based tool was developed by the former Western Beef Development Center, in 2014 for producers to use at home. The Excel tool can be used to enter your own production and financial information, throughout the Excel tool are helpful hints to guide the data entry process. A populated example is also available to show how the data can be entered into the tool.

When to record it: Annually

Example: The following video series from the former Western Beef Development Centre presents more information about the what and the how of determining cost of production: https://youtu.be/u41rVFpZxJs?t=52

Resources to help get you started:

- 2020 Cost of Production: Pasture: Government of Manitoba

- Profitability Calculator: Beef Farmers of Ontario

- Rancher’s Return Lite- Cow-Calf and Backgrounding Analysis Tool

- Cow Profits: Western Beef Development Centre

- References

-

National Beef Cattle Evaluation Consortium Sire Selection Manual

Western Beef Development Centre, 2016

Feedback

Feedback and questions on the content of this page are welcome. Please e-mail us.

This content was last reviewed October 2024.